Online Gambling Industry Report

Posted By admin On 07/04/22Industry Insights

The global online gambling market size was accounted for USD 53.7 billion in 2019 and projected to grow at 11.5% CAGR over the forecast period, from 2020 to 2027. Increasing number of smartphone users coupled with high penetration of internet among individuals for playing games through online platforms have majorly driven the market growth.

In addition, easy access for online betting and gambling, corporate sponsorships, celebrity endorsements, and legalization are some of the key factors fueling the market growth. Moreover, the Easy availability of mobile applications with cost-effective solutions across the globe is projected to further drive the market growth during the forecast period.

The internet has become a major platform for communication and it allows merchants to offer their services through websites. Since the last decade, the consumption of these services has been increased by 28%. Therefore, growing rate of internet users has increased the trend of online casinos. In addition, increasing spending capacity on leisure activities coupled with rising awareness about advanced technologies are projected to propel the market growth.

Enhancement in online spaces is directly impacting the growth of online casinos. Therefore, online casino service providers are focusing on information solutions to reach gamblers, prevent illegal information, and ensure the integrity of operations.Several online casinos are providing a free version for their games which is expected to drive the market growth opportunity.

Home / US Online Poker / The US Online Gambling Industry Has Changed Dramatically In Six Years Steve Ruddock Posted on Aug 13, 2019 05:00 PDT @SteveRuddock June 9, 2013. By Region the global online gambling industry can be classified as North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. During the year 2018, Europe ruled the market at US$ 19.91 billion. The development can be credited to the authorization of gambling in the nations for example Italy, Spain, France, Malta, and Germany.

Many countries have legalized online gambling, as it helps to generate revenue and a high rate of employment. For example, in India, Goa and Sikkim countries made online gambling legal. Additionally, online gambling allows players to experience gambling in real-time via internet services. Moreover, increasing number of sports fans globally has increased the demand for sports betting. Bets are majorly placed with football, hockey, baseball, and boxing sports which is expected to drive the market growth.

The emergence of new technologies such as blockchain and virtual reality is also fueling the online gambling market growth. This is due to market players integrating online casinos with blockchain technology to maximize their customer base. This technology integration helps them to enhance players' experience and ensure transparency in gambling activities.

On the other hand, cybercrime is one of the major challenges for this industry. Signal manipulation with fake apps as well as hacking through apps is expected to hamper the market growth to some extent. Moreover, compulsive gambling may affect individuals' personal relationships and health leads to debts or depression issues.

Type Insights

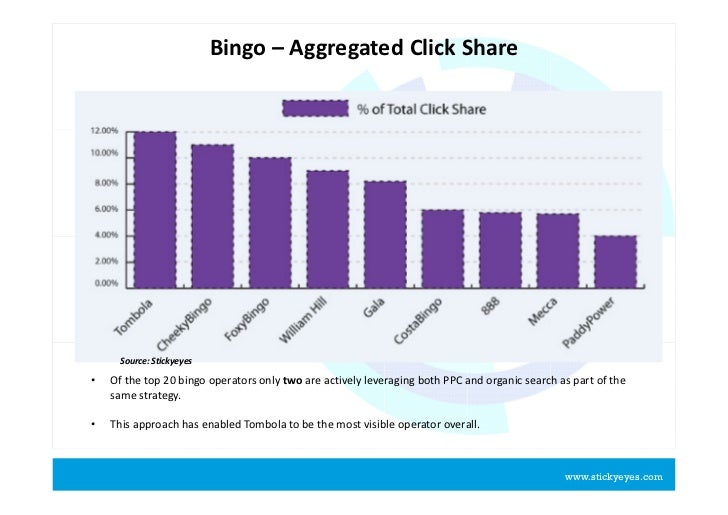

On the basis of types, the market is fragmented into sports betting, bingo, casinos, poker, and others. In 2019, sports betting dominated the global market due to the increasing usage of the digital platform worldwide. In addition, rising spending capacity and increasing smartphone users are major factors to drive the segment growth in developing regions such as Asia Pacific. Fixed-odds betting and Live-action betting are popular types in sports betting.

Online poker segment is expected to grow with significant CAGR over the forecast period due to the increasing trend of online card games. Online poker is gaining traction among college students. Convenience is a key factor responsible for gaining popularity of online poker, as various sites accept deposited through online wallets, credits card, and virtual currencies like Bitcoin. A large number of game options available for players are expected to drive the market growth.

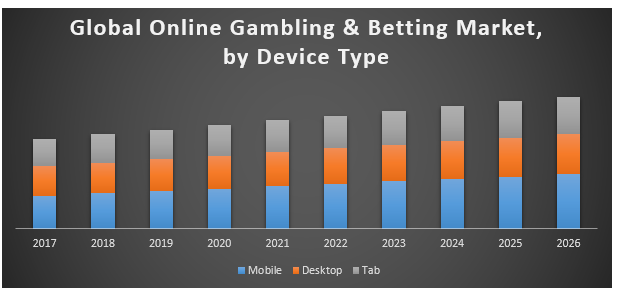

Device Insights

Based on the devices, the market is segmented into mobile, desktops, and others. In 2019, the desktop segment accounted for the largest market share in terms of revenue. Factors such as a large screen of desktops as compared to mobiles or other devices allow gamblers to intricate details of the game and enjoy the graphics. Moreover, performance parameters including sound volume, storage capacity, and picture quality can be adjusted very efficiently in order to improve the gaming experience. These factors are expected to positively contribute to desktop segment growth.

Enhancement in gaming graphics and technological innovations in mobiles has increased access to online gambling. In addition, online gambling by mobiles enables individuals to gamble fromtheir comfort zone and give uninterrupted gaming experience.

Easy availability of smartphones with advanced features such as improved graphics and high storage capacity at affordable prices is also expected to contribute to the market growth. Several benefits such as loyal points, availability of deposit options, and services to players with other players located across the world are also projected to drive segment growth over the forecast period.

Regional Insights

In 2019, Europe led the global market and generated revenue of USD 22.0 billion. This dominance is attributed to the legalization of gambling in several European countries such as Italy, Malta, Spain, and Germany. In addition, Factors like the growing popularity of online casinos, availability of high-speed connectivity, and increasing smartphone users are responsible for regional market growth. According to the Gambling Act 2005, companies have been permitted by the U.K. Gambling Commission (UKGC) to advertise gambling sites, this is expected to positively impact themarket in Europe.

Asia Pacific online gambling market is expected to witness significant growth during the forecast period. This growth is attributed to the relaxation of regulations regarding online gambling and betting coupled with increasing usage of internet services. Moreover, the increasing popularity of digital currencies like bitcoins and rising time spending on leisure activities have driven the demand for online gambling. Hong Kong and Macau are the two prominent countries for generating revenue market in Asia Pacific.

Impact of COVID-19

Online Gambling Industry Statistics

The COVID-19 outbreak is expected to witness positive impact on the market growth.To prevent the spread of coronavirus, several countries across the globe have imposed restrictions and enforcing social distancing. Strict restrictions for people’s movement are expected to have a considerable impact on land-based casino activities. Due to lockdown, several gambling players are shifting from land-based to online-based betting and gambling, thereby expected to drive the market growth in the lockdown period. On the other hand, cancellation of several sports event during COVID-19 outbreak across the globe is impacting sports gambling and betting adversely which is expected to restraint the market growth to some extent.

Online Gambling Market Share Insights

The key service prodders are focusing on innovations to differentiate and personalize their services for potential customers. Companies are adopting strategies such as collaboration, mergers & acquisitions, and product launches. For example, in 2019, William Hill PLC has acquired a Sweden based gambling company Mr. Green and Co AB. This acquisition aims to strengthen a footprint in the Scandinavian region. Some of the leading market players included in this industry are as follows:

• Bet365 Group Ltd.

• Paddy Power Betfair PLC

• Sky Betting and Gaming

• Kindred Group PLC

• GVC Holdings PLC

• Betsson AB

• William Hill PLC

• Ladbrokes Coral Group PLC

• The Stars Group Inc.

• 888 Holdings PLC

Report Scope

Attribute | Details |

Market size value in 2020 | USD 59.6 billion |

Revenue forecast in 2027 | USD 127.3 billion |

Growth Rate | CAGR of 11.5% from 2020 to 2027 |

Base year for estimation | 2019 |

Historical data | 2016 - 2018 |

Forecast period | 2020 - 2027 |

Quantitative units | Revenue in USD billion and CAGR from 2020 to 2027 |

Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered | Type, device, region |

Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope | U.S.; Canada; Germany; U.K.; China; Japan; India; Brazil |

Key companies profiled | William Hill PLC; Bet365 Group Ltd.; Paddy Power Betfair PLC; Betsson AB; Ladbrokes Coral Group PLC; The Stars Group Inc.; 888 Holdings PLC; Sky Betting and Gaming; Kindred Group PLC; GVC Holdings PLC |

Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options | Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Million Insights has segmented the global online gambling market report based on type, device, and region:

Online Gambling Industry Report

• Type Outlook (Revenue, USD Billion, 2016 - 2027)

• Sports Betting

• Casinos

• Poker

• Bingo

• Others

Online Gambling Industry Statistics Uk

• Device Outlook (Revenue, USD Billion, 2016 - 2027)

• Desktop

• Mobile

• Others

Online Gambling Industry Statistics Us

• Regional Outlook (Revenue, USD Billion, 2016 - 2027)

• North America

• The U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa